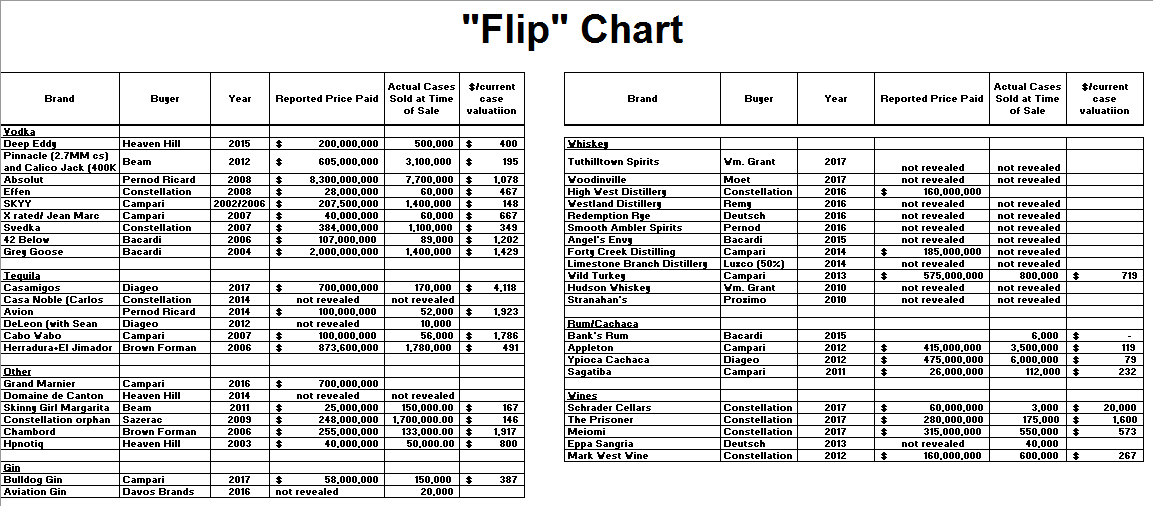

There has been a flurry of recent wine and spirit brand acquisitions with Casamigos’ $700MM/$1B sale price grabbing the headlines as the ultimate “Flip.”

With a nod to John Beaudette of MHW who taught me this rule of thumb. Check out this chart of recent brand purchases showing the reference valuation of $ sold for/current case volume.

Many people thought the Grey Goose and Absolut deals were high priced. Well, Clooney and Co. set the bar 3+ times higher with the brand valued at $4,118 per case at the 2017 forecast of 170,000 cs, and $5,833 at 2016’s 120,000 reported cases.

Even in wine, the multiples are amazing…Schrader (cult Cali Cab) sold to Constellation for $60MM for reported production of 2,500 to 4,000 cases ($24,000 to $15,000/case sold). And perhaps a more informative citation would be Huneeus’ purchase of The Prisoner for $40MM when it was doing 85,000 cases, and sold it four years later for $1,600/current case value. That’s for a brand only…there were no hard assets…no vineyard, nor winery…just the brand, ma’am.

If any of my readers have additional examples or can fill in some of the holes, please forward them to me and I’ll incorporate them into an updated chart and republish it.

And a bit of a caveat: recognize that many of the published reports of sale prices/values are approximations, and the cases sold number could be equally ambiguous…SHP? DEP? 9L case equivalents?