There’s been explosion in wine and spirits websites that fall under the title of Social Media. We’ve found it helpful to segment the category into five distinct components, so we can do a better job of identifying and leveraging the right tools to accomplish different objectives.

It all falls under one guiding strategy: instead of getting a “target audience” to come to you, go where they’re already gathered and their behavior defines their interest.

1. Platforms: Facebook, Twitter, Instagram et al. Defined as places people proactively post and engage (share, comment) with others on a platform that is socially-focused, rather than subject-focused.

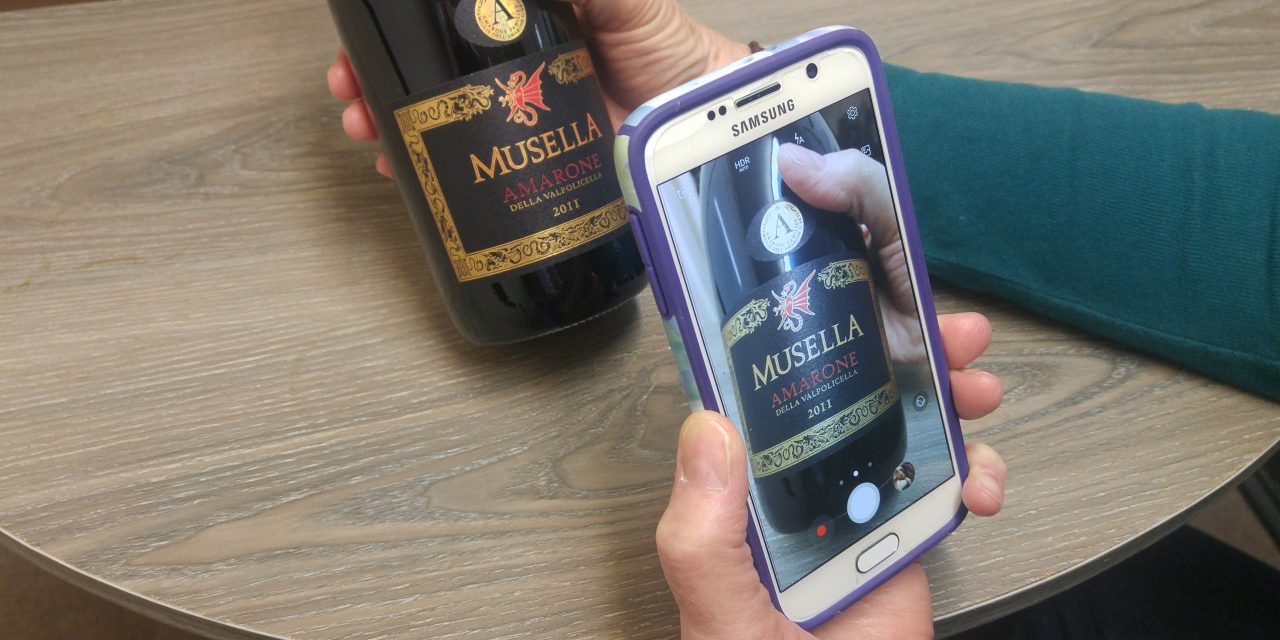

2. Tools: Wine-Searcher, Delectable, Cellar Tracker et al. Functionality-driven sites that specialize in a particular subject or service. In most cases these sites are expanding beyond their initial focus to include label recognition technology, consolidated ratings, reviews and awards from both wine critics as well as site users along with the opportunity to share and engage with fellow visitors and across platforms.

3. Sites: Vivino, Vinepair, Liquor.com et al. Destination sites where people with a specific shared interest can access information about a given subject category. Generally, these tend to attract newbies to the wine and spirit category and lean toward education and sharing information rather than providing a single utility. Many, notably Vivino, have expanded to include options for consumers to purchase, recognition that the real money is in sales.

4. Apps: Minibar Delivery, Drizly, Drync, City Hive et al. Purpose-built to provide a service to an audience interested in delivery-within-an-hour, local retail sales leveraging the collective broad inventory of stores in a given geography.

5. E-commerce: Certainly, a category that’s going through tumultuous change in the U.S., but also one with some emerging subgroups. A lot of the activity is driven by accessibility of smaller, craft and hard-to-find brands taking advantage of the “virtual inventory” concept of web-enabled tools.

- Specialty retail ecomm: Restricted interstate to 12 states but permitted intrastate in many more.

- DTC: Direct to consumer sales, currently an option only open to domestic wineries and to a limited degree, distilleries.

- Delivery-within-an-hour from Minibar Delivery, Thirstie, Saucey et al.

- Ecomm ordered/home delivery from grocery: Amazon’s recent purchase of Whole Foods and integration into Prime Now is already starting to make waves.

According to a recent Rabobank report, 2017’s wine and spirits U.S. E-commerce in total generated $1.7B in sales. Specialty retailers account for the lion’s share—today—$975MM, while DTC generated $410MM; Delivery-within-an-hour accounted for $103MM; and E-comm order/delivery from grocery $87MM. (Vivino’s recent VC funding was based on projected sales of $1B by 2020.)

The industry consensus is that interstate restrictions on e-commerce by Specialty Retail will remain challenging as states enact new laws to deal with the recent common carrier clampdown. That said, Amazon’s Purchase of Whole Foods is expected to have a seismic impact on the entire category and quickly dwarf Specialty Retail’s dominance.

One other change of note is that the new Excise Tax Law for the first time includes imported brands. We think that’s the first “chink in the armor” of regulation towards allowing imported brands to participate in DTC. Stay tuned for news on that.

Bottom line conclusion you can act on today: Label recognition technology has opened the door for marketers to connect with suspects turned into prospects whose behavior identifies them as being interested in a specific product, able to buy it, at a specific moment in time.