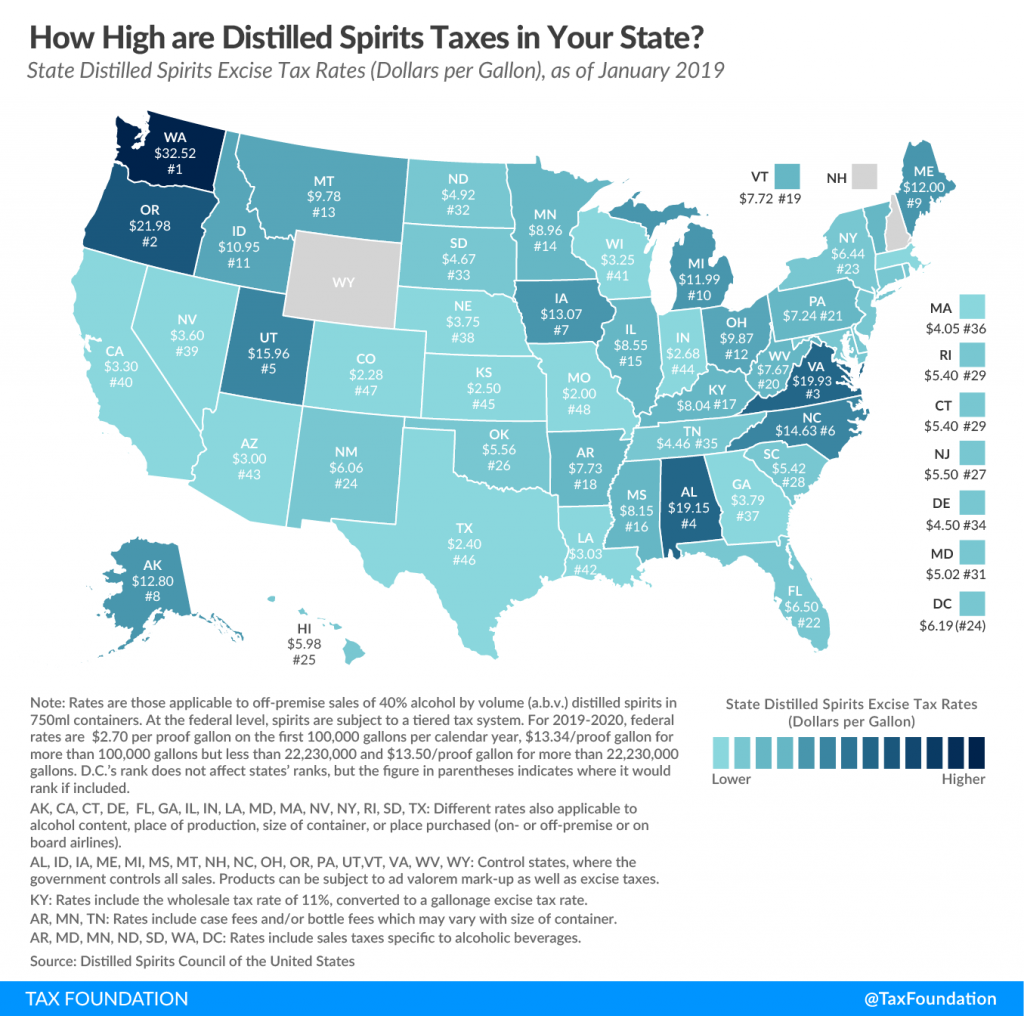

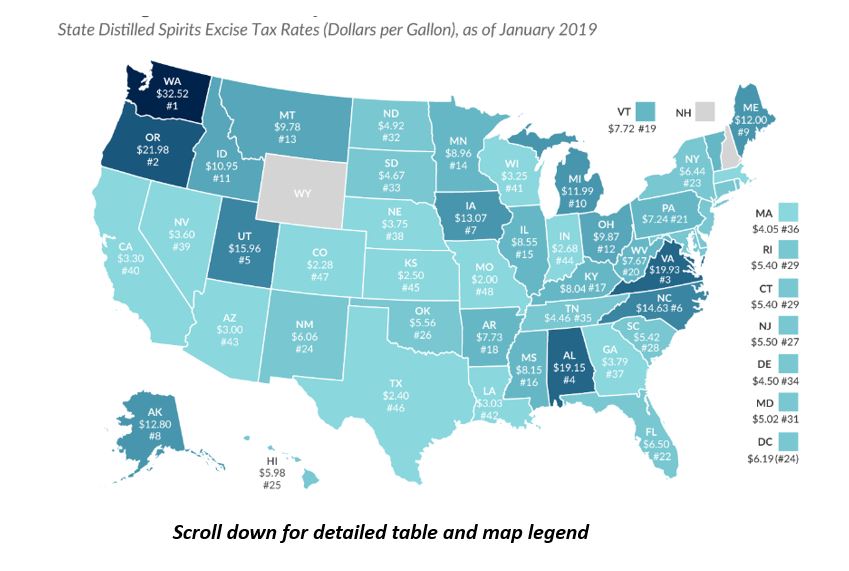

Here’s a useful table and map originally published by TaxFoundation.org using info from DISCUS which I’ve modified to include calculations showing $ per 9L cs. and $ per 750ml bottle. Be aware that state excise taxes may change year to year. (And if anyone has any updates or corrections, please let me know at steve@bevologyinc.com)

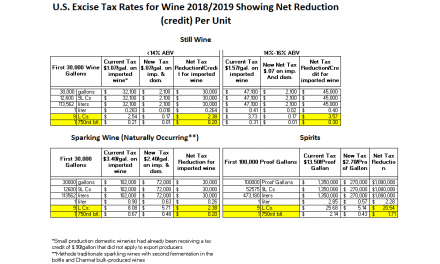

The Federal Excise Tax (FET) was significantly reduced for 2018 and 2019 by the Craft Beverage Modernization and Tax Reform Act (CBMA). That reduction (which functions as a credit) is set to expire at the end of of 2019, but there’s a lot of lobbying pressure to extend it, so stay tuned on that. Here’s a link to an article with details on that subject on my blog OH-pinions on the BevologyInc.com site.

So what’s listed below are the additional excise taxes on spirits charged by individual states. It’s one compelling reason we recommend that suppliers do price structures on a state by state basis to make sure you’re not leaving pennies on the table.

In addition to the table the TaxFoundation.org produced this map which captures some more detail on state excise taxes.