InvivoX,SJP (Sarah Jessica Parker) NZ Sauv. Blanc launches in U.S.

Sarah Jessica Parker’s partnership with the boys at Invivo Wines officially debuted at a glamorous party held outdoors at South Street Seaport in NYC on Sept. 18 and initial distribution in 20 U.S. markets. https://invivoxsjp.com/

The wine concept was the brainchild of Rob Cameron and Tim Lightbourne of Invivo Wines out of New Zealand.

I was introduced to the duo via a referral from Suzanne Kendrick of Wine-Searcher and first met with them in Auckland in Feb. to help plan the launch in the American market. Fast forward to Sept. 18 and the event marks something most folks in the industry (myself included) advise against…picking a Q4 launch date that would be a challenging time target to hit.

In this particular instance, it was made possible by the drive of Marc Taub and the fantastic team at eponymous importer Taub Family Selections. From a first convo at WSWA, the team streamlined the process that allowed the launch of an “in calendar year” 2019 vintage.

This was a fascinating project to work on not only because of the challenges faced and solved, but also because of the character of Invivo’s principals. As I learned from my visit, NZ is a land of soft-spoken, openly welcoming and friendly, coffee-crazed folks that is often conflated with Australia. Rob and Tim in particular are a 15-year overnight success with a lot of mileage developing their own label, and then a similar project with Graham Norton, popular talk show host in the U.K. Graham’s visibility, and his initials…think sauviGNon blanc and the newly introduced GiN are topping the sales charts there

The InvivoX,SJP project built on the learnings from that success, and adapted the model to SJP who created the label art and the unique requirements of the U.S. market…an area where I helped a bit. And of course, the partnership with Sarah Jessica Parker resonates so incredibly well with the target audience of fashion-conscious female consumers. Add SJP’s active presence on social media, and particularly with a 5 million strong Instagram following is perhaps the most effective marketing tool in their quiver: leveraging existing aware and loyal SJP followers, engaging with her during the journey and now commercialization.

So, the party has just started, stay tuned to see how well the brand does through Q4 and look for extensions in the months to come, likely to include a Provençal Rosé and a more “serious” red from a country-to-be-named–later.

Looking for similar results? E-mail me at steve@bevologyinc.com, or better yet, just call +1 860-269-4777.

Photo above of the Invivo/TFS team: (l. to r.) Tim Lightbourne, Invivo; Jeff Popkin, TFS; Elizabeth Mitchell, TFS; Susan Anne Cosgrove, TFS; Rob Cameron, Invivo; Steve Raye, Bevology; Marc Taub, TFS; Diego Avanzato, TFS

2020 Industry Trade Shows, Conferences

While most of us are focused on O/N/D, it’s also a good time to start planning for 2020. Below is a list—in chronological order—of industry trade shows, conferences, seminars and summits that are relevant to the U.S. “Bev. Alc.” business.

If you have any to add, please let me know at Steve@bevologyinc.com

Fancy Food Show: San Francisco (Jan. 19-21, 2020), New York (June 23-25, 2020) https://www.specialtyfood.com/

Wine and Spirits Daily Summit 2020: Jan 13-14, 2020. Palm Beach, FL. https://winespiritsdaily.com/summit.php

South Beach Wine and Food (consumer/trade crossover): Feb. 19-23, 2020, Miami, FL. https://sobewff.org/

Vinexpo Paris, Feb. 10-12, 2020, Paris, France. https://www.vinexpoparis.com/?lang=en

TexSom: Feb. 17-19, 2020, Dallas TX. https://texsom.com/

Vinexpo New York: March 2-3, 2020, New York. https://www.vinexponewyork.com/

ProWein, March 15-17, 2020, Dusseldorf, Germany. https://www.prowein.com/

One Step Beyond (The Buyer Conference WSTA, Jump Start) Mar. 4, 2020, London, UK http://www.the-buyer.net/2020-one-step-beyond/the-buyer-helps-launch-new-consumer-tech-trends-conference-one-step-beyond/

American Craft Spirits Assn. Annual Convention, March 29-31, 2020. Portland, OR. www.americancraftspirits.org

World Wine Meetings, 2020 TBA (usually March), Chicago and San Francisco, CA. https://www.wwm-chicago.com/index.php/en

Nightclub and Bar, March 30-April 1, 2020, Las Vegas, NV, https://www.ncbshow.com/

American Distilling Institute 2020 Conference and Expo April 6-8, 2020. New Orleans, LA, www.distilling.com

Vinitaly, April 19-22, 2020, Verona, Italy https://www.vinitaly.com/en/

WSWA Convention (Wine and Spirits Wholesalers of America), April 20-23, 2020, Las Vegas, NV http://www.wswaconvention.org/

3Tier Wine Symposium, May 7, 2020, Santa Rosa, CA 3tierwine.com

Future Wine Expo, Santa Rosa, CA. May 12-13, 2020 https://futurewineexpo.com/en/

World’s Leading Wines: New York, May 11, 2020; Chicago May 13, 2020; San Francisco May 15, 2020; Houston, May 18, 2020. http://worldsleadingwines.com/

NABCA (National Alcohol Beverage Control Association), May 18-21, 2020 Marco Island, FL https://www.nabca.org/meetings

USA Trade Tasting: New York May 26-27, 2020 https://usatradetasting.com/

Aspen Food and Wine Classic (crossover), June 19-21, 2020, Aspen, CO. https://www.foodandwine.com/promo/events/aspen-classic/classic-main

Bar Convent Brooklyn, June 9/10, 2020, Brooklyn, NY https://www.barconventbrooklyn.com/Home/

Tales of the Cocktail, July 21-26, 2020 New Orleans, LA https://talesofthecocktail.org/

International Bulk Wine and Spirits Show, July 28-29, 2020, San Francisco, CA https://ibwsshow.com/

ECRM/Marketgate Global Wine, Beer and Spirits Program, August 23-26, 2020, Santa Rosa, CAhttps://ecrm.marketgate.com/Sessions/2020/08/GlobalWineBeerandSpiritsEPPS

Wine Industry Technology Symposium, 2020 TBA (usually Oct), Napa, CA https://www.winebusiness.com/industryEvents/?go=eventDetails&event_id=13268

New York Wine Experience (consumer/trade crossover): 2020 TBA, usually October, New York, NY https://www.nywineexperience.com/

Bar Convent Berlin, 2020 TBA, usually in early Oct., Berlin, Germany https://www.barconvent.com/en/

Wine2Wine: 2020 TBA, usually Nov/Dec, Verona, Italy https://www.wine2wine.net??lang=en

SommCon: 2020 TBD. Washington DC usually June, San Diego usually November http://sommconusa.com/

Craft Beverage Trade Show, 2020 TBA, usually Louisville in Dec. https://www.craftbeverageexpo.com/

Wine Media Conference (formerly Wine Bloggers Conference), Date and location TBA https://www.winemediaconference.org/

Fancy Food Show: San Francisco (Jan. 19-21, 2020), New York (June 23-25, 2020) https://www.specialtyfood.com/

Wine and Spirits Daily Summit 2020: Jan 13-14, 2020. Palm Beach, FL. https://winespiritsdaily.com/summit.php

South Beach Wine and Food (consumer/trade crossover): Feb. 19-23, 2020, Miami, FL. https://sobewff.org/

Vinexpo Paris, Feb. 10-12, 2020, Paris, France. https://www.vinexpoparis.com/?lang=en

TexSom: Feb. 17-19, 2020, Dallas TX, https://texsom.com/

Vinexpo New York: March 2-3, 2020, New York. https://www.vinexponewyork.com/

ProWein, March 15-17, 2020, Dusseldorf, Germany. https://www.prowein.com/

One Step Beyond (The Buyer Conference WSTA, Jump Start) Mar. 4, 2020, London, UK http://www.the-buyer.net/2020-one-step-beyond/the-buyer-helps-launch-new-consumer-tech-trends-conference-one-step-beyond/

American Craft Spirits Assn. Annual Convention, Portland, OR, March 29-31, 2020. www.americancraftspirits.org

Nightclub and Bar, March 30-April 1, 2020, Las Vegas, NV, https://www.ncbshow.com/

American Distilling Institute 2020 Conference and Expo April 6-8, 2020. New Orleans, LA, www.distilling.com

Vinitaly, April 19-22, 2020, Verona, Italy https://www.vinitaly.com/en/

WSWA Convention (Wine and Spirits Wholesalers of America), April 20-23, 2020, Las Vegas, NV http://www.wswaconvention.org/

World Wine Meetings, 2020 TBA (usually March), Chicago and San Francisco, CA. https://www.wwm-chicago.com/index.php/en

World’s Leading Wines: New York, May 11, 2020; Chicago May 13, 2020; San Francisco May 15, 2020; Houston, May 18, 2020. http://worldsleadingwines.com/

USA Trade Tasting: New York May 26-27, 2020 https://usatradetasting.com/

NABCA (National Alcohol Beverage Control Association), May 18-21, 2020 Marco Island, FL https://www.nabca.org/meetings

American Distilling Institute 2020 Conference and Expo (www.distilling.com), New Orleans, LA, April 6-8, 2020

Bar Convent Brooklyn, June 9/10, 2020, Brooklyn, NY https://www.barconventbrooklyn.com/Home/

Aspen Food and Wine Classic (crossover), June 19-21, 2020, Aspen, CO. https://www.foodandwine.com/promo/events/aspen-classic/classic-main

Tales of the Cocktail, July 21-26, 2020 New Orleans, LA https://talesofthecocktail.org/

SommCon: 2020 TBD. Washington DC usually June, San Diego usually November. http://sommconusa.com/

International Bulk Wine and Spirits Show, July 28-29, 2020, San Francisco, CA https://ibwsshow.com/

Wine Media Conference (formerly Wine Bloggers Conference), Date and location TBA https://www.winemediaconference.org/

Wine Industry Technology Symposium, 2020 TBA (usually Oct), Napa, CA https://www.winebusiness.com/industryEvents/?go=eventDetails&event_id=13268

New York Wine Experience (consumer/trade crossover): 2020 TBA, usually October, New York, NY https://www.nywineexperience.com/

Bar Convent Berlin, October2020, Berlin, Germany https://www.barconvent.com

Wine2Wine: 2020 TBA, usually Nov/Dec, Verona, Italy https://www.wine2wine.net??lang=en

Craft Beverage Distribution Conference & Trade Show, 2020 TBA, usually Louisville in Dec. held parallel to Craft Beverage Expo https://www.craftbeverageexpo.com/

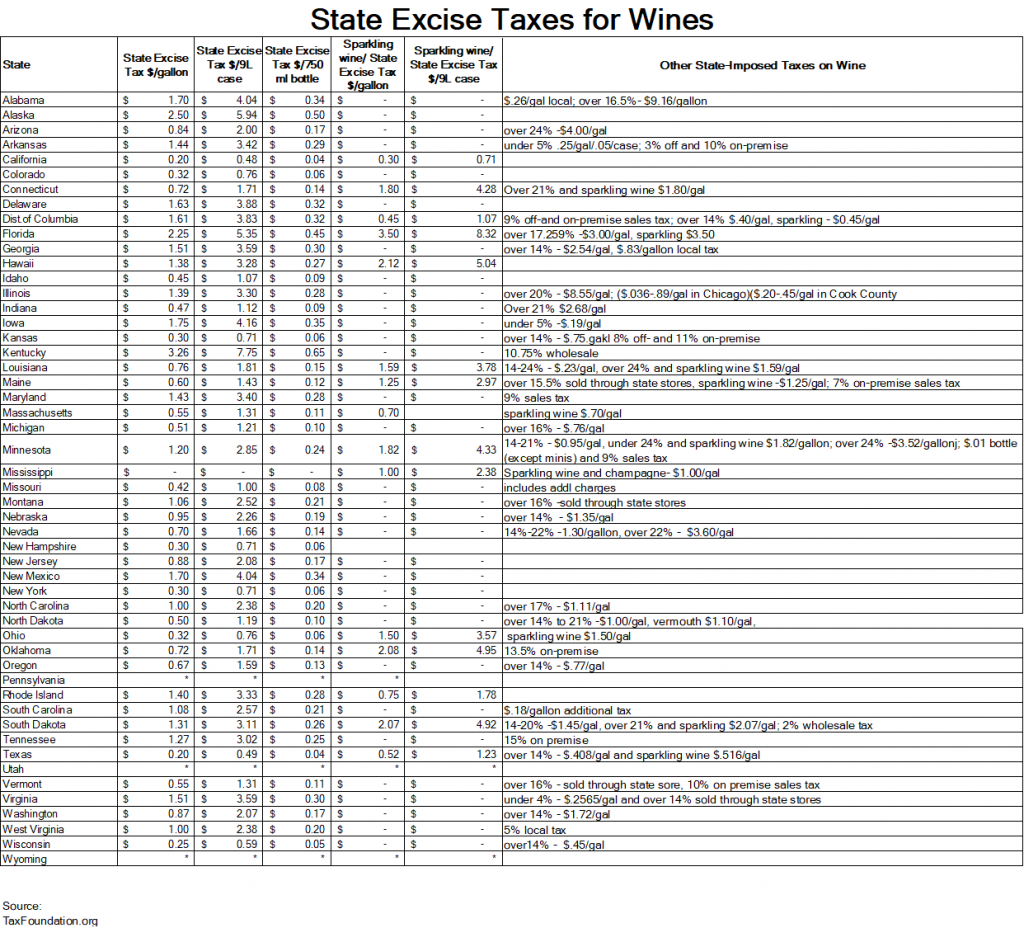

State Wine Excise Taxes Updated

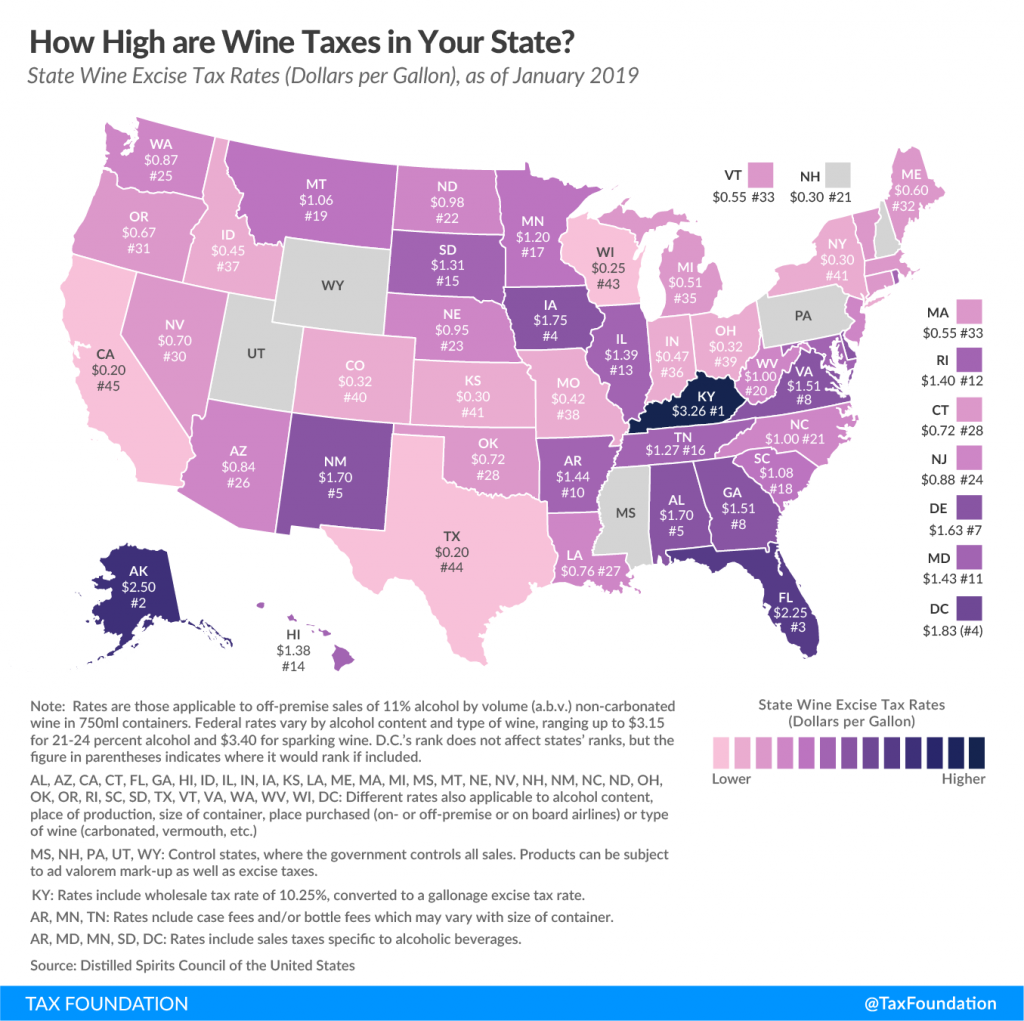

As a corollary to my previous article on state spirit excise taxes, pasted below is similar data for excise taxes on wines by state as of Jan. 2019. Also pasted below the table is a map published by TaxFoundation.org that shows more detail by state.

And if anyone has any updates or corrections, please let me know at steve@bevologyinc.com and I’ll correct and update these graphics.

I’ll be posting a couple of articles on the implications and integration of state excise taxes on pricing strategy and structures next week.

And as noted in the state spirit tax post, wines too are benefiting from significantly reduced FET (Federal Excise Taxes) via the CBMA credit program, scheduled to conclude Dec. 21, 2019. Stay tuned as there is a lot of lobbying going on to extend the Federal tax credit program for both wines and spirits.

And below is the full TaxFoundation.org map showing the legend

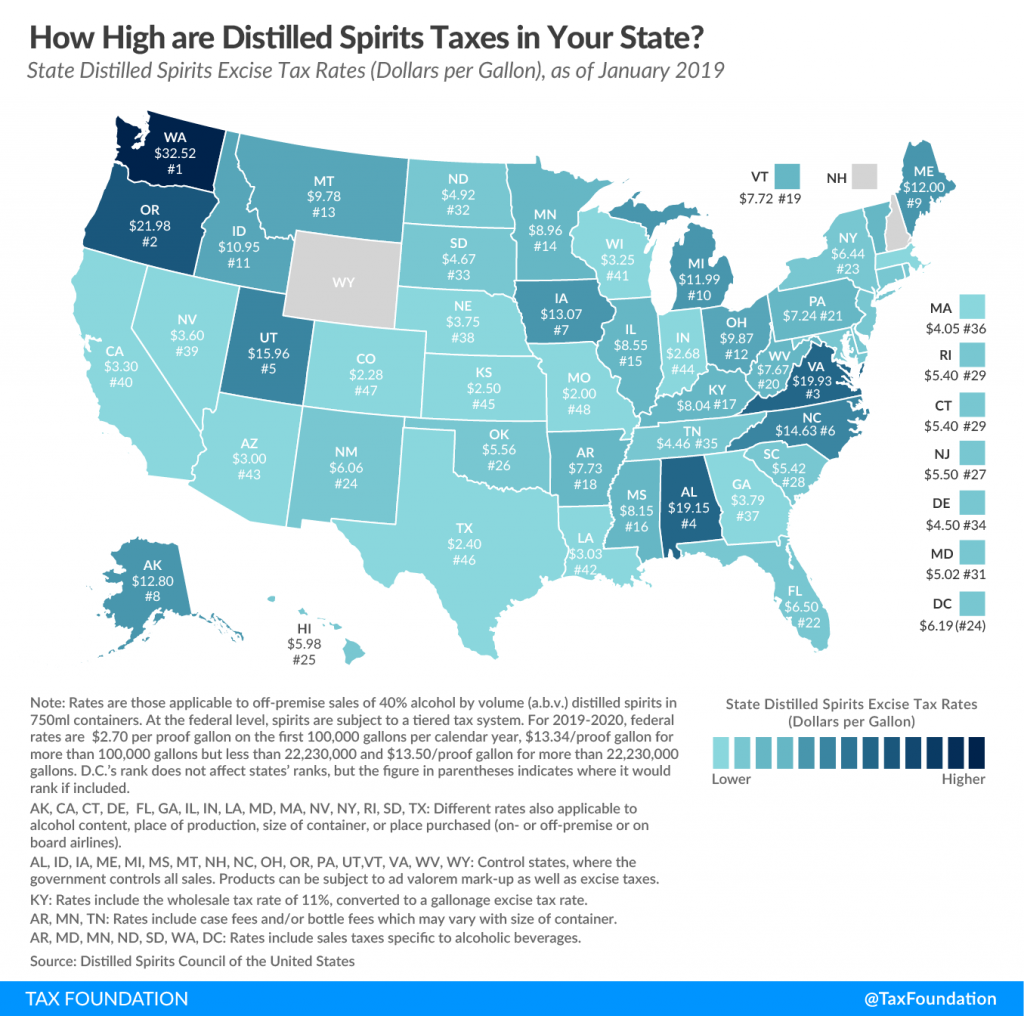

State Excise Taxes for Distilled Spirits

Here’s a useful table and map originally published by TaxFoundation.org using info from DISCUS which I’ve modified to include calculations showing $ per 9L cs. and $ per 750ml bottle. Be aware that state excise taxes may change year to year. (And if anyone has any updates or corrections, please let me know at steve@bevologyinc.com)

The Federal Excise Tax (FET) was significantly reduced for 2018 and 2019 by the Craft Beverage Modernization and Tax Reform Act (CBMA). That reduction (which functions as a credit) is set to expire at the end of of 2019, but there’s a lot of lobbying pressure to extend it, so stay tuned on that. Here’s a link to an article with details on that subject on my blog OH-pinions on the BevologyInc.com site.

So what’s listed below are the additional excise taxes on spirits charged by individual states. It’s one compelling reason we recommend that suppliers do price structures on a state by state basis to make sure you’re not leaving pennies on the table.

In addition to the table the TaxFoundation.org produced this map which captures some more detail on state excise taxes.

Top 4 Tips for Presenting Brands to Chain Buyers at Trade Shows

Here’s a link to an interview I did with Joe Tarnowski of ECRM/Marketgate at the Beer Wine and Spirits program held in New Orleans. I had the opportunity to attend the speed dating meetings in this unique event and identified four key learnings for how wine and spirit producers can make better pitches to chain buyers.

I’ll be posting an article outlining those in more detail next week, but for now, watch the video here: https://www.youtube.com/watch?v=o91vvylzEVE

Part 2: UK Wine Show Podcast with Chris Scott

Here’s a link to the second part of my interview with Chris Scott of the UK Wine Show Podcast. It was recorded at Wine2Wine in Verona and Published this summer. https://www.thirtyfifty.co.uk/uk-wine-show-detail.asp?id=600

UK Wine Show podcast interview

Chris Scott’s UK Wine Show aired the first of a two part interview with me talking about the U.S. market. https://www.thirtyfifty.co.uk/uk-wine-show-detail.asp?id=599

The interview took place in November in Verona, Italy at the formal introduction of my new book How to Get U.S. Market Ready and we also talked about the the challenges…and solutions… for export brands entering the U.S. market

The book is available directly through the website www.GetUSMarketReady.com, and through Amazon.com in the U.S. In the E.U. and ROW, the book can be purchased through Amazon.it.

Can You Hear Me Knocking?

FINALLY, the Supreme Court of the U.S. (SCOTUS) issued their decision on a case that has the potential to change the playing field for interstate retailer e-commerce. While the case did not deal with e-comm directly, supporters of expansion of interstate ecommerce of beverage alcohol are praising it for clarifying the conversation as it applies to retailer direct shipping.

The substance of the ruling is that the Granholm decision, which is the foundation for interpreting many of today’s direct shipping laws, applies not just to producers and products, but also to retailer DtC sales.

Background: E-commerce of beverage alcohol (principally speaking about wine here) from retailers to consumers in states other than their own is only permitted in 14 states. E-commerce from domestic wineries in one state to consumers in another state is allowed in approx. 40 states (It’s not allowed at all between international wineries to consumers in any state.) E-commerce from retailers to consumers in their own state is permitted in approx. 36 states.

Confusing? Yes indeed. So. the hope was that the ruling in this case would be broad enough to sever the Gordian Knot that is bev. alc. e-commerce.

It didn’t do that. However, it does lay the groundwork for a broader interpretation of what’s legal.

The Internet Will Out. Here’s another perspective at the controversy. As we all know, e-commerce is the elephant in the room when it comes to bev. alc. sales. I have a chart that shows that only 4% of the national market for the category of bev. alc. currently goes through some form of e-commerce. Compare that to books or shoes where the numbers are greater than 50%. So basically, bev. alc. is inhibited from meeting consumers’ expectations to be able to buy everything via e-commerce. Add in Amazon’s interest in being able to sell everything to everybody and you have some powerful forces at play potentially impacting a multi-billion-dollar industry structure that many think is hide-bound and untouchable.

So now what? I’m sure we’ll be hearing a lot of opinions on what this all means, and here’s my take on it. (And be aware I’m speaking specifically from the point of view of smaller domestic producers and those export brands that are clamoring to break into the U.S. market, but are being stymied by the three-tier system.)

It’s a whole new world. Innovative solutions are emerging that work within the three-tier system but are structured to service brands that can’t get the attention or approval of “traditional” distributors. I’m talking specifically about LibDib here, but it also relates to service importers such as MHW, Park Street, T. Elenteny, USA Wine West and American Spirits Exchange. These five say “Yes!” to everyone looking for an importer, and most have distribution licenses in states such as CA, NY, FL and others. Like me, we’re all working to find ways for new brands to break into the U.S. market.

I think we’ll see a lot more creativity from retailers on DtC models that will test the limits of today’s SCOTUS ruling. Correspondingly, I expect producers/suppliers/importers to develop innovative marketing programs with direct delivery to consumers as the end goal. And whether that’s through wine clubs, crowd-funding strategies such as Naked Wines, delivery-within-an-hour solutions such as Minibar Delivery, through existing purwe e-commerce via Wine.com, or the next generation of retailer direct, I think we’ll be seeing big things, pretty quickly.

Opportunity is Knocking, so open the door! Most people don’t realize when opportunity comes knocking, because it’s wearing dirty overalls and looks like work. I love that imagery!

Top 5 Tips for Successful Selling in the U.S. Market Webinar Thursday June 20

Join me as I talk about the top 5 tips for successful selling of wines and spirits in the U.S. market. The free webinar is part of my collaboration with my friends at LibDib, and will focus on options suppliers (“Makers” using LibDib-speak) of wines and spirits have for selling their products in the U.S.

So whether you’re new to the U.S. market or just looking for new ideas on how to enter and grow here…sign up to attend. It will be a great learning opportunity and a great training tool for staff.

Register here: https://bit.ly/31A5ir0

Wine Relationship Brokers

I was featured in a recent article with that title written by Liza Zimmerman (Lizathewinechick) in Meininger’s Wine Business International, with a nod to How to Get U.S. Market-Ready book. (Click on the link to register and get a free first chapter, or buy the whole book. The print version is now available in the U.S. and globally.)

The key points Liza picked up on were the importance of prospective exporters being educated on the U.S. market, and finding a way to communicate the success of the brand, even before launch. I know, that sounds like a paradox, but it’s really not. It just requires a bit of creativity.

A case in point referenced in the article is Invivo Wines, with which I’m working to help launch their Invivo X SJP brand. Still a work in progress, but on track to launch in September with a powerful push from Sarah Jessica Parker’s social media support.

Most brands we work with, of course, don’t have the celebrity leverage. But for every brand one we work with we help identify what I like to call a “Point of Difference that Makes a Difference.” And it’s this POD that MAD distinction that can make the difference between success and failure for new brands.

Want more ideas on how to do this? Here are two ways: 1) Buy the book, it’s loaded with case histories and examples of how we’ve done that for other clients. And 2) check out some of my prior blog posts on the subject, also with practical case histories and metrics.