Free Webinar from ECRM & Bevology: Overview of the U.S. Wine and Spirits Market

I’m collaborating with ECRM/Marketgate to put on a free webinar this coming Wednesday May 8, 2019 at 10:00AM EDT (New York time). The webinar will provide an overview of the American alcoholic beverage market and is free to all.

To reserve your spot in the free webinar go to https://ecrm.marketgate.com/Webcast/Register/840.

The webinar is just one part of my involvement with the “Global Wine, Beer and Spirits” program which will be held in New Orleans Aug. 25-28, 2019. For more details click on over to: https://ecrm.marketgate.com/Sessions/2019/08/GlobalWineBeerandSpiritsEPPS

The second part will also be a webinar to be held in June, exclusively for brands exhibiting at the program. And the third will be hosting a round table discussion help exhibitors fine tune the presentation of their brands to meet the specific needs of buyers at the event itself.

For those of you not familiar with them, ECRM specializes in programs in which participants attend prearranged meetings of motivated buyers and sellers. In this case of the Wine, Spirits and Beer program, that means key regional and national volume buyers in the U.S. such as United and American Airlines, Lucky’s Supermarkets, Walgreen’s chain drug and Mass Merchants including Kmart, along with Coast Guard and Military exchanges.

I spoke at and attended the event a couple of years ago and came away quite impressed. It’s a great “non-traditional” strategy to kick start U.S. market sales.

Free 3-Day Immersion Course in Italian Wine

My friends at the Italian trade agency (ITA/ICE) are conducing a series of educational courses billed as world-class, intensive and immersive and open to people working in the trade including somms, beverage directors, retailers, suppliers, importers, distributors, reps and media.

My understanding is it will be a “lite” version of Stevie Kim’s Vinitaly International Academy.

The NY event (May 14-16) is just about full but here’s the list of the other confirmed cities and dates:

CHICAGO, IL: June 4-6, 2019

COLUMBUS, OH: July 23-25, 2019

WASHINGTON, DC: July 30-Aug. 1, 2019

DENVER, CO: Sept. 17-19, 2019

MIAMI, FL: Sept. 23-25, 2019

Courses will also be held in 2020 in Los Angeles, Dallas, Philly and Boston with dates TBD.

Here’s the link to sign up: https://docs.google.com/forms/d/e/1FAIpQLSf1xhMR8da97fsZ6CIAYzOMdh80ayx8lSdwSSWzI6JN00Pxag/viewform

And here’s the link with deets on topics, regions etc.: http://extraordinaryitalianwine.us/request-access/

And yes, there will be a test (for official certification)

Just Released: Sonoma State Research Report on Digital/

I’m sharing a research report courtesy of a team of wine marketing profs. from Sonoma State University and published by WineBusiness.com. The subject was digital marketing by domestic U.S. wineries, but the numbers are a good point of reference for export wineries as well.

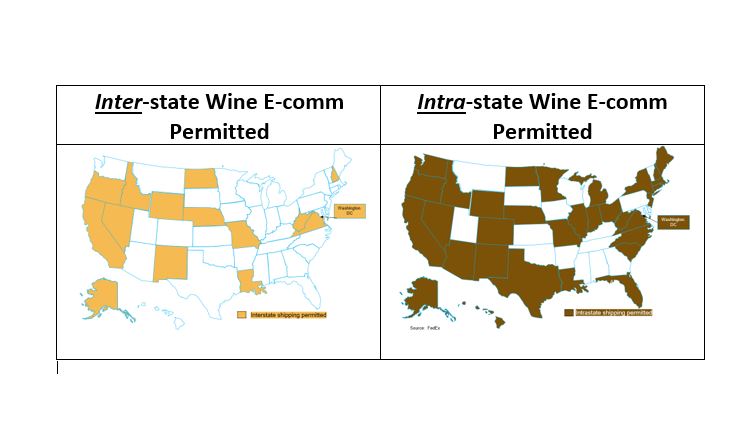

And a note to export producers…We’re all waiting with bated breath to hear the ruling by the U.S. Supreme Court on a case that will have potentially significant impact on wine e-commerce. The decision is anticipated to come in May/June.

Are You Selling Enough Wine Online? Status of Digital Marketing Strategies of U.S. Wineries

by Liz Thach, MW, Damien Wilson, and Pierre Costa

April 22, 2019

Global online retail sales reached $2.3 trillion in 2017—a 24 percent increase over the previous year – and is expected to grow to $4.8 trillion by 2021, according to eMarketer. All around the world consumers are increasingly using their fingertips to shop rather than visit brick and mortar stores. Indeed, Pew Research reports that 79 percent of American now shop online. When it comes to wine however, a recent survey of over 1,000 U.S. wine consumers shows that only 27 percent have purchased wine online. Part of the reason for this is onerous shipping regulations that differ by state, the need for an adult signature to receive alcohol, and high shipping costs. But could there be another reason?

Could it be that U.S. wineries are not reaching out to consumers via digital marketing the way companies in other consumer products industries are?

The World of Digital Marketing

In order to investigate this hypothesis, a survey was developed jointly by Sonoma State University Wine Business Institute (WBI) and SommDigital.com. The purpose was to examine digital marketing strategies and practices used by U.S. wineries. The results reveal that there are a number of innovative wine businesses that are adopting and benefiting from digital marketing, but that others are struggling. This survey also serves as a benchmark that can now be measured over time.

Methodology

An online survey was developed and beta-tested before sending it out to a list of 3,362 email addresses obtained from the Wine&Vines database. The email was sent to individuals responsible for making digital marketing decisions, and job titles associated with Marketing, DTC/Wine Club, Public Relations, and Sales. Two follow-up emails were sent over the course of 3 weeks to remind wineries to complete the survey. In the end, a usable set of 257 responses was collected. The data were analyzed for significant differences using Microsoft Excel.

About the Respondents

Wineries from 30 U.S. states responded to the survey, with 58 percent from California, 10 percent from Oregon, 5 percent from Washington, and the remainder from other states. Case production included 59 percent from small wineries producing less than 10,000 cases annually; 35 percent producing 10,000 – 500,000 cases; and 6 percent producing more than half a million cases. Forty-four percent of the respondents said they were the winery owner. In terms of customers who purchase wine online, an average of 51 percent were identified as wine club members, with the remaining 49 percent being consumers who were attracted to the website to purchase wine.

Results – Broad Range of Digital Practices Being Used

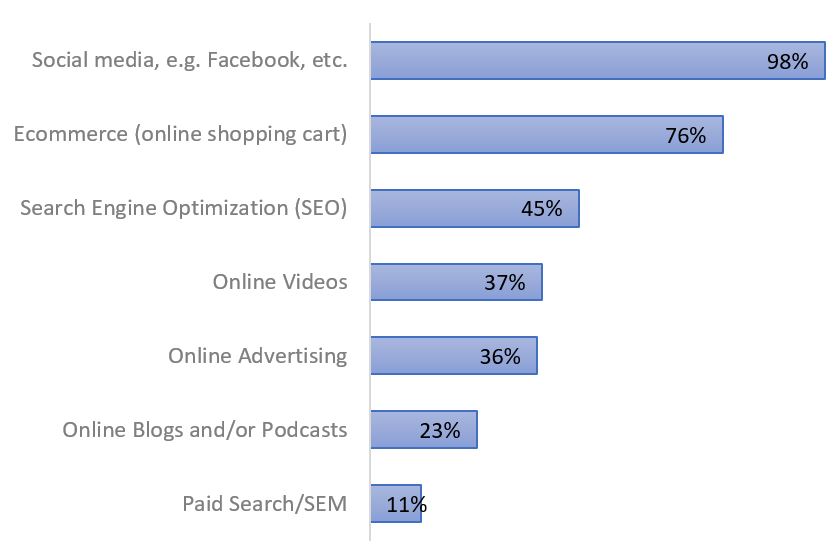

Digital marketing can be defined as “any form of online interaction for the purpose of creating demand for products and services.” This can occur on any online platform, such as computer, tablet, or mobile phone. With this in mind, respondents were asked which of seven major digital practices they were engaged in. The findings (Chart 1) show that U.S. wineries are using all of these practices, with social media used most commonly by 98 percent of the sample; followed by e-commerce at 76 percent and SEO at 45 percent. Least used was paid search/SEM at 11 percent.

Chart 1: Major Digital Marketing Practices Used by U.S. Wine Industry

Social Media Usage

Since social media were used so frequently, we analyzed the types of social media platforms and discovered that Facebook is used the most at 98 percent, Instagram 88 percent, Twitter, 67 percent, Yelp 47 percent, TripAdvisor 46 percent, and YouTube at 35 percent. Since Facebook is more popular with older demographics and Instagram with younger consumers, this is positive to learn that many wineries are reaching out to both segments. It also shows that they are concerned with monitoring customer rating sites such as Yelp and TripAdvisor to support positive wine tourism. However, there appears to be more opportunity to engage with consumers via video platforms.

Digital Marketing Goals

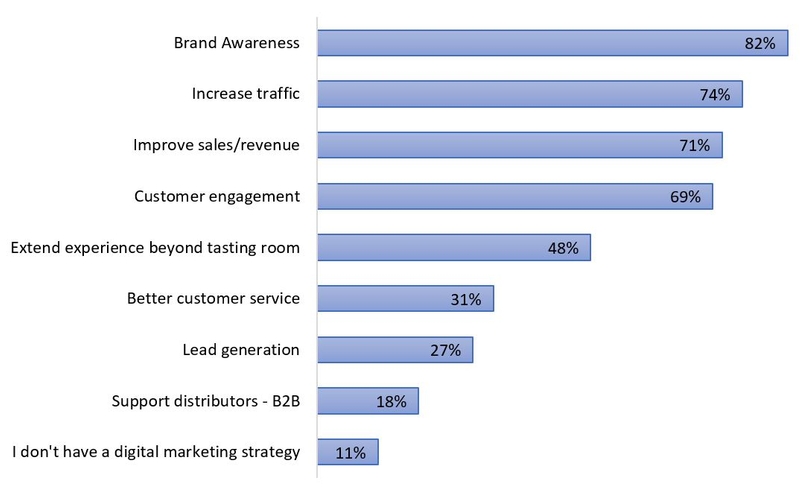

Clarity and measurement around digital marketing goals are considered to be two of the most important actions when implementing digital marketing strategy. Therefore, respondents were asked: “What are the major goals for your digital marketing strategy? Check all that apply.” The results show that brand awareness is the most important goal at 82 percent of the sample, followed by increasing traffic to website 74 percent; improving sales revenue 71 percent; and customer engagement at 69 percent. Overall these goals seem positive, but when asked about measurement, 34 percent of the sample reported they do not measure digital marketing results.

Chart 2: Winery Goals for Digital Marketing

Labor and Budget for Digital Marketing

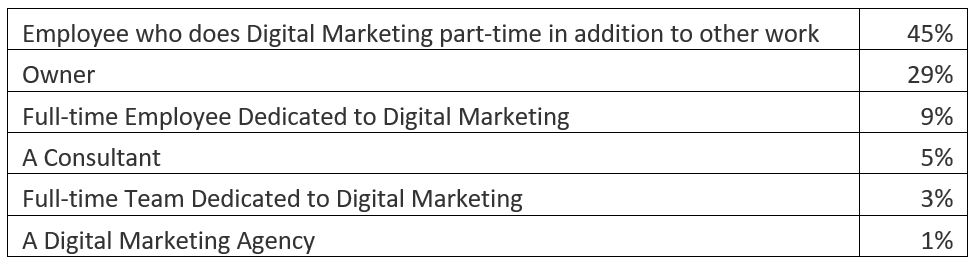

In terms of who is responsible for implementing digital marketing (See Table 1), 45% of respondents reported they delegate it to an employee who has other job responsibilities, but 29% of the work is actually performed by the winery owner. A smaller number have a dedicated employee for digital marketing or outsource it. In terms of how much of the marketing budget is spent on digital,42% said they spend 5% or less on digital, but 25% reported they spend 21% or more of their marketing budget on digital.

Table 1: Who Performs Digital Marketing Work at Your Winery?

Challenges in Implementing Digital Marketing

When asked about challenges faced with implementing digital marketing strategies, the top issue was a lack of knowledge identified by 45 percent of the sample, followed by a lack of qualified staff at 36 percent, shipping regulations at 35 percent, and cost at 31 percent. These challenges are consistent with findings from research in other industries regarding the adoption of new technologies.

Activities to Increase Online Wine Sales

Despite these challenges, a small percentage of the sample reported that they are currently achieving 21 percent or more of their revenues via online wine sales. Therefore, this group was compared against the rest of the sample to determine what, if anything, they were doing differently. The results show statistically significant differences in the categories listed below:

- Focus on Lead Generation – higher online revenue-generating

wineries were much more concerned with generating online leads with

customers

- Higher Use of Online Video – wineries with higher online revenue

reported a much higher use of online video platforms, such as YouTube.

- Database Analysis – these wineries made sure to analyze online

consumer purchase history and online interactions with consumers so they

could understand their needs and provide targeted wine promotions and

recommendations.

- Online Event Promotion – winery events were advertised and communicated in multiple online platforms to a larger extent.

- Shipment Restriction Concerns – when asked about challenges, the

major concern of higher online revenue-generating wineries was shipment

restrictions

- Case Size was NOT Significant – meaning that it didn’t matter if the winery was small, medium, or large in size. This is consistent with other research findings on wine digital marketing.

These differences provide some direction for wineries who are interested in increasing their online wine sales. By focusing first on activities such as online promotions and advertising to attract more consumers to their website, this will generate more leads which can result in higher wine sales revenues. Likewise, adopting an Amazon approach of analyzing customer needs and purchases through database analysis, and then customizing online offers, should also result in higher sales. More use of videos should also be considered. According to BI Intelligence, videos will represent 82 percent of the web traffic by 2021, and Hubspot reports that 64 percent of users are more likely to buy a product online after watching a video. Finally using all available social media platforms to communicate about winery events, as well as via online newsletters, emails, and other digital methods is a good way to encourage consumers to visit the winery. Most likely, in the future, we will see more online winery events as well, where consumers can participate virtually in winery events.

Summary and Implications

These results show that wineries are adopting digital marketing practices, but that there is more opportunity to gain knowledge in the field, get clear on goals and measurement, and expand methods to attract customers to their website. Wine businesses thus need to invest more resources, and implement an effective strategy for the roll-out of digital media across their business in order to take advantage of this opportunity over the long term.

References

Business Insider Intelligence ( 2017) ,Video will account for an

overwhelming majority of internet traffic by 2021. June 12, 2017.

Available at: https://www.businessinsider.com/heres-how-much-ip-traffic-will-be-video-by-2021-2017-6

eMarketer. (2018) Worldwide Retail and Ecommerce Sales. Available at: https://www.emarketer.com/Report/Worldwide-Retail-Ecommerce-Sales-eMarketers-Updated-Forecast-New-Mcommerce-Estimates-20162021/2002182

Hubspot (2018). The Ultimate List of Marketing Statistics for 2018 (Source: https://www.hubspot.com/marketing-statistics)

Pew Research (2016). Online shopping and ecommerce. Available at: https://www.pewinternet.org/2016/12/19/online-shopping-and-e-commerce/

Thach, L. & Camillo, A. (2018).Snapshot of the American Wine Consumer in 2018. Winebusiness.com. Dec. 10, 2018. Available at: https://www.winebusiness.com/news/?go=getArticle&datald=207060

by Liz Thach, MW, Damien Wilson, and Pierre Costa

About the Authors: Dr. Liz Thach, MW (liz@lizthach.com) and Dr. Damien Wilson (Damien.wilson@sonoma.edu) are both professors at Sonoma State University’s Wine Business Institute. Pierre Lincoln Costa (pierre@sommdigital.com) is the Founder of SommDigital, a firm that focuses on offering digital marketing solutions to global wineries (http://SommDigital.com)

Bevology Partners with Best Wine Importers U.S. Import and Distribution Database

I’ve just started working with Best Wine Importers (BWI), a database company HQ’d in London that specializes in lists of wine and spirit importers and distributors around the globe.

For export Drinks brands looking for an import strategy for the U.S. market BWI is a great resource to start with. They include info on over 8,000 importers around the world and 1,195 specifically in the U.S.

What I specifically find valuable about the BWI database…beyond its scale and scope…are a couple of valuable features. One is a “trusted” label issued only to importers that, through personal reviews and research by the BWI staff, have qualified for a “Trusted” label. The key focus of the research is on reputation and payment history of the importers. That’s something that’s critically important to new-to-the-U.S. brands.

As part of our partnership. BWI is offering new customers a free copy of How to Get U.S. Market-Ready book. Our mutual goal is to provide exporters with the data they need in terms of contact information, but also the insight into the process of getting a U.S. importer.

So, if you’re looking for an importer for the American market, check out www.BestWineImporters.com. Not only will you get a searchable, sortable, multifactor database of candidates, you’ll also get the benefit of my 30 years in the business via a free copy of my book. The book goes into great detail on key information exporters need including understanding price structures, open vs. control states, franchise states, new taxation laws (U.S. FET taxes have recently dropped by 90% for wines, spirits and beers), and how to choose the right markets specifically for your brand entry and roll out.

Pricing: Factor in “Next” Along with “Now”

There’s a common mistake we see made by brands that are new to the U.S. or are managing sales from the home country. It has to do with “Pricing for the transition to a distributor.”

We recommend that brands look at importing as a two-phase project.

Phase 1 is to start with a service importer such as MHW Ltd. or Park Street. This allows a brand to launch in the U.S. quickly, but still preserve their options as they develop a business case.

Phase 2 is when they look to attract a “forever” importer.

When price structures are created for launch through the service importer’s distribution license, keep in mind that they don’t charge a traditional importer or distributor margin, per se. Rather they have a menu of service offerings with costs associated with each.

Brands need to factor in that at some time in near future they will get a

“forever” importer or “traditional” distributor that will charge a markup/take a margin for their services.

So when the initial price structure for distribution in each state is set up, it’s imperative that the calculations build in that future importer & distributor margins. If you do the price structure based on the actual costs of using a service importer, more than likely you’ll end up with a selling price that will be significantly lower than a traditional importer–Distributor–on/off-premise structure would command

So what? Well, what will happen is the new distributor will use their system to calculate a price, factor in their standard margins, and the product that you may have been selling to retail at $14.99, now comes in at $19.99. Ouch!

And what usually happens then is when the on- and off-premise retail customers you got during Phase 1 (Service importer phase), find out that your price just went up (to them, and in turn to an MSRP), they will be unlikely to reorder. And that’s being nice.

So, get smart. Make sure that when you’re doing pricing in the U.S. you’re factoring in “next” along with the “now.”

And a caveat: If this point isn’t absolutely crystal clear to you. That’s a sign you need help. So, give me a call. That’s what I do: help brands NOT make the same mistakes other brands have made before them, again, for the first time. You’ll find that covered in detail in the chapter titled “Price Structures Illuminated” on pp 118-121 of my new book: How to Get U.S. Market Ready. So head on over to Amazon.com and buy a copy today. I guarantee you will find that it was the best $30 you ever invested in the U.S. market.

What’s Next, Next?

Liza Zimmerman did a great job of summarizing a “look over the horizon” based on one of the panel discussions held this week at Vinexpo New York in an article that ran on Wine-Searcher’s Newsletter. (You can read the whole article…and its worth it…here: https://www.wine-searcher.com/m/2019/03/challenging-times-ahead-for-us-wine.)I was there as well and was equally impressed with what the panel had to say. They were: Chris Adams, CEO Sherry-Lehman; Bill Terlato, CEO Terlato Wines; Rick Tigner, CEO of Jackson Family Wines; Steve Slater, EVP/GM of Southern Glazer’s Wine & Spirits. To be clear, what they said wasn’t unknown, but it did help put into perspective some of the actions wine and spirit producers can and should be taking now to capitalize on what’s coming next, next.

So here’s the advice I’ve been giving to my clients: Every spirit and wine brand, whether currently imported into the U.S. or wants to be, needs an e-commerce strategy and infrastructure plan for two contingencies: 1) If the pending Supreme Court case decision includes and impacts e-commerce with their ruling in June, and 2) a strategy/infrastructure plan for the status quo. The key for the latter is a more positive proactive understanding over the impact on interstate e-commerce resulting the common carrier crackdown. The reality, intrastate e-commerce is rapidly growing in the 30+ states where intrastate shipping from retailers to consumers in a given state is allowed. And it represents a powerful tool for smaller brands to be able to compete on a more level playing field with their peers, as well as mega brands.

Sparkling wine producers also need a strategy for branding, positioning and pricing for to exploit the radical change in appreciation and purchase of sparkling wines that Prosecco has created. This speaks not only to Champagne of course, but also Cava from the Spain, Crémant from France, and sparklers from Franciacorta and TrentoDOC in Italy, to bubble brands produced in every other country.

Canned wines have finally come of age. Producers need to explore how they can add value to the concept. Or better yet, do cans better than what’s already out there by looking at factors such as pressures, residual sugar, protecting flavors and packaging of not just individual units but multipacks and carriers.

A strategy for Amazon’s blockbuster announcement in 2017 buying Whole Foods, and their latest statement about entering the grocery business. I’ve been saying since the Whole Foods deal that it was ironic that the leader in e-commerce finally figured out they had to buy a brick and mortar chain in order to do e-commerce in the wine biz. My point being that Amazon wasn’t getting into the wine e-comm business. They were more interested in redefining the grocery business from one of commodities and price competition, to focusing on family meals and adding value to the experience.

Delivery-within-an-hour programs such as Drizly and Minibar Delivery are just scratching at the surface of the convenience aspect of purchasing alcoholic beverages. The same opportunity applies to them…how to add value to the meal experience, only in this case covering not just wine, but spirits and beer as well.

Rethink and restate your brand positioning in terms of telling stories, and leveraging emerging tools that are on the cusp of redefining how people buy bev alc. Here I’m talking about not just social media, apps such as Vivino, VinePair and Wine-Searcher, but also the transformative impact label recognition will have on the industry. Think “long tail” for labels. Add to that the 19 Crimes case history (and extension into beer) and you can see just how tectonic that change will be.

Lastly, have a strategy for DtC (direct to consumer). Right now it’s a door open only to domestic and craft producers…and one embraced by the smaller ones who have been blocked out of the three-tier system. I believe import brands will be able to participate in that route to market soon. And I say that because the CBMA tax credit was the first chink in the armor of the Federal Government limiting export producers with a different set of rules.

Bottom line, change is constant. Successful producers will be the ones who anticipate the future and use creative leadership and nimbleness to exploit new opportunities before they actually arrive.

What do you think?

Metrics that Matter

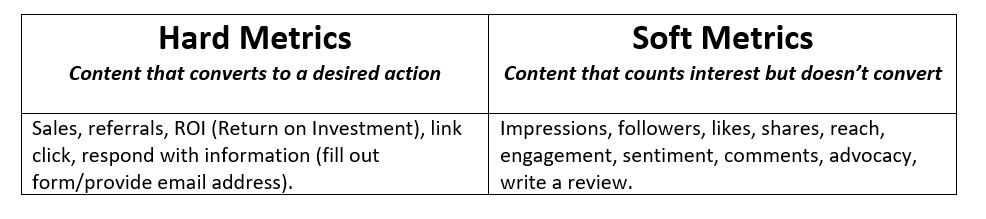

One of the big challenges we face with new-to-the-U.S. and new-to-the-World suppliers is a practical understanding of social media marketing objectives and metrics.

In the olden days (ca. 2010) fans and followers were what got counted, reported and used as a yardstick. Unfortunately those metrics didn’t and still don’t provide any real value, much less insight.

There’s a rich choice of tools now, both native (Google/Facebook/Twitter analytics) and purpose-built that can be integrated into a brand’s social media management infrastructure.

But whatever tool or scheme you use, we’ve found it incredibly important to separate the soft from the hard metrics.

So here’s a handy little chart I use to help us and our clients stay focused on measuring what matters…action.

I talk about this subject in more depth in my new book How to Get U.S. Market-Ready, available on Amazon.com and Amazon.it in the EU. I’m also offering a FREE chapter to anyone who registers at www.GetUSMarketReady.com.

Trade Shows and Conferences Relevant to Doing Business in the U.S. Wine and Spirits Market

Fancy Food Show: https://www.specialtyfood.com/

Wine and Spirits Daily Summit 2021: https://winespiritsdaily.com/summit.php

South Beach Wine and Food (consumer/trade crossover): https://sobewff.org/

Vinexpo Paris, Feb. 10-12, 2020, Paris, France. https://www.vinexpoparis.com/?lang=en

TexSom: Dallas TX, https://texsom.com/

Vinexpo New York: https://www.vinexponewyork.com/

ProWein Dusseldorf, Germany. https://www.prowein.com/

American Craft Spirits Assn. Annual Convention, Portland, OR, March 29-31, 2020. www.americancraftspirits.org

Nightclub and Bar, March 30-April 1, 2020, Las Vegas, NV, https://www.ncbshow.com/

American Distilling Institute 2020 Conference and Expo April 6-8, 2020. New Orleans, LA, www.distilling.com

Vinitaly, April 19-22, 2020, Verona, Italy https://www.vinitaly.com/en/

WSWA Convention (Wine and Spirits Wholesalers of America), April 20-23, 2020, Las Vegas, NV http://www.wswaconvention.org/

World Wine Meetings, 2020 TBA (usually March), Chicago and San Francisco, CA. https://www.wwm-chicago.com/index.php/en

World’s Leading Wines: New York, May 11, 2020; Chicago May 13, 2020; San Francisco May 15, 2020; Houston, May 18, 2020. http://worldsleadingwines.com/

USA Trade Tasting: New York May 26-27, 2020 https://usatradetasting.com/

NABCA (National Alcohol Beverage Control Association), May 18-21, 2020 Marco Island, FL https://www.nabca.org/meetings

American Distilling Institute 2020 Conference and Expo (www.distilling.com), New Orleans, LA, April 6-8, 2020

Aspen Food and Wine Classic (crossover), June 19-21, 2020, Aspen, CO. https://www.foodandwine.com/promo/events/aspen-classic/classic-main

Tales of the Cocktail, July 21-26, 2020 New Orleans, LA https://talesofthecocktail.org/

ECRM/Marketgate Global Wine, Beer and Spirits Program, August 23-26, 2020, Santa Rosa, CAhttps://ecrm.marketgate.com/Sessions/2020/08/GlobalWineBeerandSpiritsEPPS

SommCon: 2020 TBD. Washington DC usually June, San Diego usually November. http://sommconusa.com/

International Bulk Wine and Spirits Show, July 28-29, 2020, San Francisco, CA https://ibwsshow.com/

Wine Media Conference (formerly Wine Bloggers Conference), Date and location TBA https://www.winemediaconference.org/

Wine Industry Technology Symposium, 2020 TBA (usually Oct), Napa, CA https://www.winebusiness.com/industryEvents/?go=eventDetails&event_id=13268

New York Wine Experience (consumer/trade crossover): 2020 TBA, usually October, New York, NY https://www.nywineexperience.com/

Wine2Wine: 2020 TBA, usually Nov/Dec, Verona, Italy https://www.wine2wine.net??lang=en

Craft Beverage Trade Show, 2020 TBA, usually Louisville in Dec. https://www.craftbeverageexpo.com/

Chiaretto, Italy’s Surprising Rose’

I visited the Bardolino region this year with a group of other journalists and came away, surprised, delighted, and with a whole new appreciation of what makes Rosé, well Rosé. My memory of the category was tainted with the bottles of Mateus and Lancer’s we drank in college (and thought of as cool at the time.) They were cloyingly sweet, frizzante and totally alien to what we know of as modern Rosé.

Flash forward to today, and to Bardolino, a charming little village on the east shore of Lake Garda, an hour or so drive a bit North by West of Verona. Bardolino is a town name, and a wine appellation that covers a number of different wine types and styles. In the case of Chiaretto (pronounced Key-ah-ret-o, with a rolling “r”) there’s quite a bit of history. The earliest documents reference the word in 1806, but the wine as we recognize it now was an innovation of an Italian wine pioneer.

The name comes from the Italian word for “pale,” chiaro, and the etto on the end makes it “little pale one.” As I said, it’s got some serious historical chops, and part of that is because the grapes used for the wine are the primary ones used in many other Veneto wines and regions including Valpolicella and Amarone: corvina primarily, filled out with rondinella and molinara.

Key to Chiaretto’s popularity is the young, fresh flavors of citrus fruit balanced with bracing acidity. Or as one of our company said, “in your face freshness.”

We got to try a variety of Chiarettos alone, with lunch, as an aperitif, paired with a variety of the region’s traditional specialties…salumi (cured meats), local cheese, olives and pizza. And it’s the latter that really made a connection for me. We ate at Saporé one night in Verona, which is one of the best pizza joints in all of Italy (and right up the street from the still-standing “Lion’s Gate” from Roman times.) Yowza, a match made in heaven.

All of the producers we met really impressed me and one was a real surprise, Daniele Delaini’s Calicantus, a biodynamic producer who is in the process of renovating his family’s 15th century estate (wish I had one of those) after leaving a banking career in Milan. That’s him in the photo above with a spectacular view overlooking Lake Garda.

I was also lucky to return to Verona in early December to speak at Stevie Kim’s Wine2Wine industry think tank. while there we took the opportunity to visit Carlo Nerozzi at his Le Vigne di San Pietro in the hills of Sommacompagna. Carlo produces Chiaretto and Bardolino and his wines were the first from Bardolino to win a prestigious Due Bicchieri in the Gambero Rosso competition. Sue and I were there with our friends Maurice and Val Healy from the U.K. who discovered a Steinway grand and treated us to an impromptu concert of Nancy Whiskey and Your Song, which made it that much more enjoyable.

So, yeah, you can say I converted. I’ve given up the rep of the guy who says no way to Rosé, and will be enjoying it with the family at this year’s Christmas gathering. So, ask for Chiaretto at your local wine shop. Trust me, it’ll be worth it.

DtC in 2019: Great news for wine, not so bad news for spirits

A recent Rabobank report picked up in Mark Brown’s Industry News Update highlighted the second-class status of spirits as it relates to DtC (Direct to Consumer) sales in the U.S. And given the importance of O/N/D for both categories as gift items, it’s a major problem this year, with huge potential down the road.

Wine as a category can be shipped either intrastate (30+ states) or interstate (only 12 permitted) by retail stores in the U.S. Domestic wineries can ship DtC to approximately 39 states. Amazon’s purchase of Whole Foods opens up a huge new channel. Per Rabobank, that adds up to 7% of the total wine market or over $3 Billion.

Spirits on the other hand are more severely limited. Only five states allow DtC spirits shipments (depending on how you read the regs) and many retailers don’t want to even take the chance of getting on the wrong side of the issue.

So, the good news is for wine. Tremendous opportunity for growth, especially when you look at the “head-space” comparison between wine and other FMCG (Fast Moving Consumer Goods) such as clothing and of course books. Adding rocket fuel to that potential are a number of things:

–Tremendous innovation in navigating the DtC space for wine. Apps such as Minibar Delivery and Drizly (which also sell spirits in some markets) have established a firm foothold. And new ones coming down the pike at a seemingly accelerating rate.

–Explosion of non-traditional retail distribution and purchase schemes such wine clubs, and concurrent private or control label brands selling through clubs as well as retailers from Costco to Gary’s in NJ.

–“Non-traditional” distribution apps have moved from pariahs to partners. Witness the recent partnership of RNDC and LibDib. Merchant 23 is another angling to reach critical mass.

–The Supreme Court has agreed to hear a case that likely will have a significant impact and potentially expand what the Granholm decision gave to domestic wines to retailers, imported wine and potentially spirits.

The bad news is for spirits…at least for right now. The future does look rosier with Kentucky leading the way in permitting DtC sales with a law change in 2018. And I love the comment Rabobank made: Kentucky, perhaps aspiring to its state slogan “Unbridled Spirit.” And it’s, possible, but unknown whether the Supreme Court decision would apply to spirits.

I personally don’t see Amazon jumping on the spirits bandwagon until they sort out strategies for DtC wine via Whole Foods stores (they’re in 44 states, however not all of which permit store-delivered DtC)

The bottom line, however, is that though the DtC bev. alc. biz was severely reined in with the common carrier constraints imposed by Fed Ex and UPS in Dec. 2016, the industry stands poised for dramatic growth.

And I think what the RNDC/LibDib association portends is really significant. My read is that the senior guys who only recently had pooh-poohed DtC app potential within the Three-Tier System in the past, have come around to recognize that it’s not only acceptable, it’s going to be the future of the industry. Kudos to Tom Cole and Cheryl Durzy!

I cover the subject in much greater depth in my new book: “How to Get U.S. Market-Ready.” You can register and get a free first chapter at www.GetUSMarketReady.com, and the book is available in Kindle version right now on Amazon.com, and print in January.

What’s your point of view?